A super change to your retirement balance

This simple rule change could add $50,000 to your retirement balance.

You'll be able to concentrate on work and trust your super is being paid. Photo: Getty

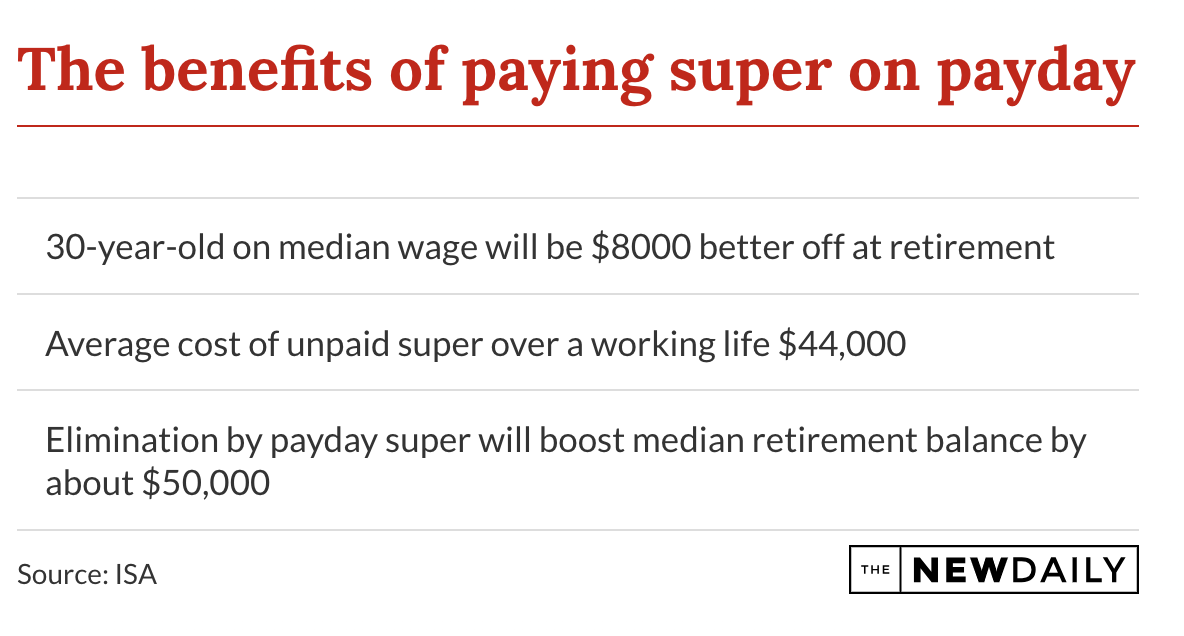

The average Australian’s superannuation balance could be as much as $50,000 better off if the payday superannuation legislation currently up for discussion is passed into law.

The move would see super contributions paid to workers quarterly changed to every pay period.

Paramount Financial planner Wayne Leggett said the move was “a wonderful idea”.

“If you’re investing money and you think it’s going to make strong returns, then the sooner it hits your account then the better off you are,” Leggett said.

On the flip side “the employer doesn’t get the benefit of hanging on to superannuation money as long until it has to be put in”, Leggett said.

That means they are earning money for the boss, not you.

If they are paid into your fund every time the boss pays your wages, you are getting the benefits of the returns earned on those funds sooner.

Work done by Industry Super Australia found that payday super payments could mean an extra $8000 in retirement benefits for a 30-year-old on the median wage.

Super theft

The other advantage payday super payments would have is that it would make super underpayment by employers much more difficult.

That’s because you could see at a glance at your payslip that your super has been paid with wages and salaries.

Currently with the payments made quarterly it is easy for employees to lose track of them and not know whether they are being paid the correct benefits and paid them on time.

ISA has done a lot of work on the magnitude of super underpayments, which is effectively theft of employee entitlements.

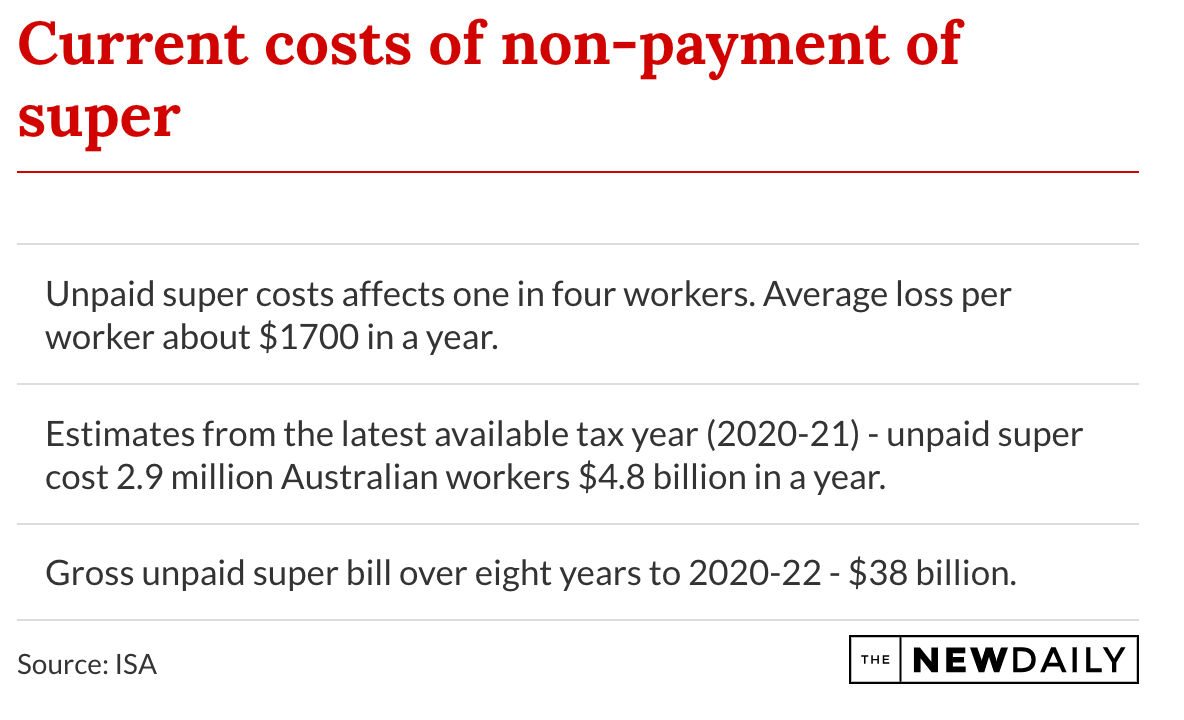

They determined that unpaid super affects about one in four workers and the average effect spread across the workforce amounts to about $1700 a year per person.

Back in 2020-21, the latest year for which data is available, that amounted to 2.9 million workers missing out on super they were owed which totalled $4.8 billion in a year or $38 billion over eight years.

The ATO has measured it back over time so you can see what a difference that theft of super makes.

Who will benefit?

Overall the government says about 8.9 million Australians will benefit from higher retirement savings from receiving their super guarantee contributions earlier and more frequently throughout their working life.

This change will apply to all employers from July 1, 2026, and there will be consultations until the 2024-25 budget to ensure glitches and difficulties are removed from the system.

Chant West’s research director Ian Fryer is also a supporter of the move and thinks it will have immediate benefits.

“I love the idea of payday super which should reduce non-payment as it will be immediately clear on an employee’s payslip whether their super was paid or not,” Fryer said.

However, employers might look at changing their pay arrangements to deal with the reform.

“What they haven’t thought about is half of Australians are employed by small business,” Leggett said.

“Someone like me will consider changing fortnightly payments to monthly, so I only have to make payments half as often because for me that’s a downside.”

That downside is the extra work for employers in organising the superannuation payments more often, along with the loss of access to superannuation monies to be paid to workers.

There could be a hitch

There is another possible negative response that could result from payday payments.

“Super funds might start increasing their administration costs because they are currently processing money quarterly,” Leggett said.

Were they to process contribution money on a weekly or fortnightly basis, they might put up admin charges to take account of the extra administration burden that would entail.

Even were that to happen, Leggett believes “there would be a net benefit to fund members”.

ISA said in a statement the move would be “one of the most significant improvements to the super system in 30 years”.

“When combined with an extra $40 million promised to the ATO to chase super non-payments, it has the potential to deliver billions more into the retirement savings of millions of Australian workers.”

The biggest winners from the move are likely to be younger, lower-paid workers, including a high proportion of women who are most likely to be underpaid their super entitlements.

Not only will the move boost super savings for millions of workers, it will boost government coffers because contributions tax will be paid on the extra superannuation contributions made as a result of the legislation.

This story first appeared in The New Daily, which is owned by Industry Super Holdings