Super funds shift investments amid post-COVID changes

Superannuation funds are altering investment portfolios to protect members’ money as the economy changes in the aftermath of the pandemic.

Questions over office values are forcing super funds to change investments. Photo: TND

Recent figures produced by regulator APRA showed that total superannuation balances grew 7.6 per cent over the year to June 30 2023, rising to a total of $3.54 trillion.

That increase came as the median balanced super fund returned 9.2 per cent despite some choppy times in sharemarkets.

But within the overall figures, super funds were using some nifty footwork to look after members’ money in unusual times.

Property dip

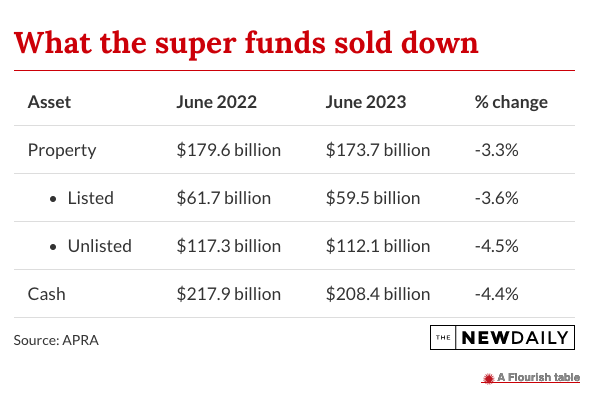

Property holdings, long a favourite of super funds across the pooled superannuation sector, fell by 3.3 per cent to $173.4 billion.

That category excludes self-managed super funds which are regulated by the ATO, so APRA has no access to their investment makeup.

Within those property holdings, listed property declined 3.6 per cent and unlisted 4.5 per cent.

The main reason for that move away from property is “driven by ongoing concerns about commercial property where returns haven’t been that crash hot as bond rates rise”, independent economist Harley Dale said.

Those property concerns are driven by post-COVID changes as the demand for office space declines with more people working from home, at least part of the week. That has cut the value of office buildings as vacancy levels rise.

In mid-August, the country’s biggest super fund, AustralianSuper, announced its unlisted property portfolio had suffered losses of eight per cent for the June year.

As a result, “we are looking to reposition the property portfolio and invest in more sectors that did well such as industrial warehouses and logistic centres,” investment communication manager Sam Weaner told a webinar.

It seems that others are doing the same with a $6 billion reduction in property exposures across the sector.

The decline in office property valuations is significant to super funds.

“About half of unlisted property for super funds is made up of investments in the office sector which is why it matters so much,” Rainmaker research director Alex Dunnin said.

Funds are looking to rejig their portfolios to increase holdings in different property types to get away from the hits to the office sector.

“Industrial property is going from strength to strength as warehouses, factories and distribution centres see increased demand,” Dunnin said.

Infrastructure jump

The reduction in property holding values is being offset with increases in infrastructure investment.

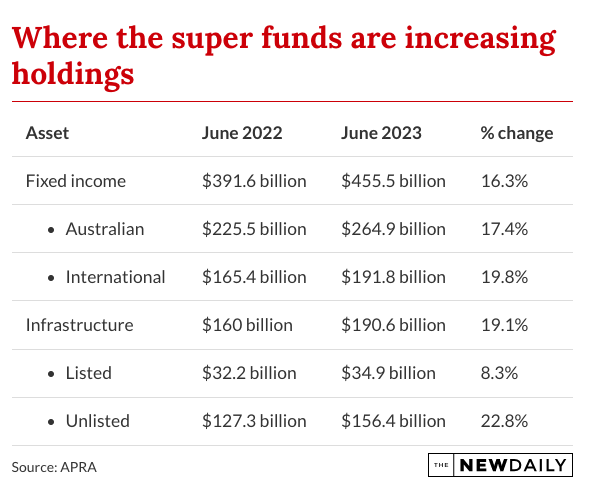

Infrastructure holdings for pooled super funds have jumped a massive 19.1 per cent with the unlisted sector, where most of the investments are held, increasing 22.8 per cent to $156.4 billion.

Overall, the sector has $191.8 billion invested, which means it has overtaken property as an investment class.

That, independent economist Saul Eslake says, is a matter of demand and returns.

“There’s an awful lot of infrastructure spending going on, particularly in Victoria and New South Wales, and super funds are a major source of financing for those projects these days,” Eslake said.

So the big infrastructure companies and governments are increasingly going to the super funds to help pay for their projects and the funds are only too happy to oblige.

“They are a good investment for super funds because of their lengthy lifespan,” Eslake said.

Infrastructure also tends to offer steady returns so funds are using it to make up for the weakening office market.

The other major growth area for super fund investment has been the bond market.

In recent times bond markets were a source of losses for super funds because interest rates were rising, which pushes down bond values.

Bonds attractive

But now as interest rates are seen as being near their peak they have become an attractive asset for funds.

“If you believe that interest rates are near their peak then that’s a good time to be buying bonds because as interest rates come down their capital value increases,” Eslake said.

Fixed-income (bond) holdings by super funds increased by 16.3 per cent to $455.5 billion over the June year.

That was a greater increase than equity holdings, which rose in value by 14.1 per cent.

Consequently, funds’ cash holdings fell by 4.4 per cent to $208.4 billion as super funds saw better opportunities elsewhere.

Doubts about values in the office sector will remain for some time.

“I think there is still uncertainty about the extent to which demand for office space will go back to pre-COVID levels,” Eslake said.

COVID is also influencing the demand for industrial property which was not only strong because of demand for consumer goods.

“It would appear from statistics that manufacturers and wholesalers are choosing higher levels of inventory than they were pre-COVID for fear of disruptions to supply chains,” Eslake said.

The moves by the super funds to change investment priorities are a good thing for members.

“It’s not that their actions are unusual, it’s more that circumstances are unusual and there are some big issues out there that funds are reacting to,” Dunnin said.

This story first appeared in our sister publication The New Daily, which is owned by Industry Super Holdings