Life is full of unexpected events, and it is important that everyone with a super balance considers what will happen to their super when they die.

This is especially important for super holders of advanced years.

Even if the matter was thought about years ago, possibly when a person’s children were young, this decision may need to be reviewed because non-dependents are treated differently from dependents tax wise.

Superannuation is treated differently in law from the rest of a person’s assets and people need to think about it separately, said Thabojan Rasiah, principal of Rasiah Private.

“You need to make sure you make a binding death benefit nomination for superannuation,” Rasiah said.

That can be done through your super fund, but there are a few tricks to think about.

Firstly, make sure you sign a binding, as opposed to non-binding nomination, because that way the fund trustees will have to comply with it.

Secondly, think about signing a non-lapsing binding nomination as it will last until you change it. The lapsing variety expires after three years.

If you make no nomination then it is up to the trustees to decide what to do with your money on death. Generally, it will go to your dependents or your will.

But if you have no will then it will be dealt with according to the intestacy laws in your state.

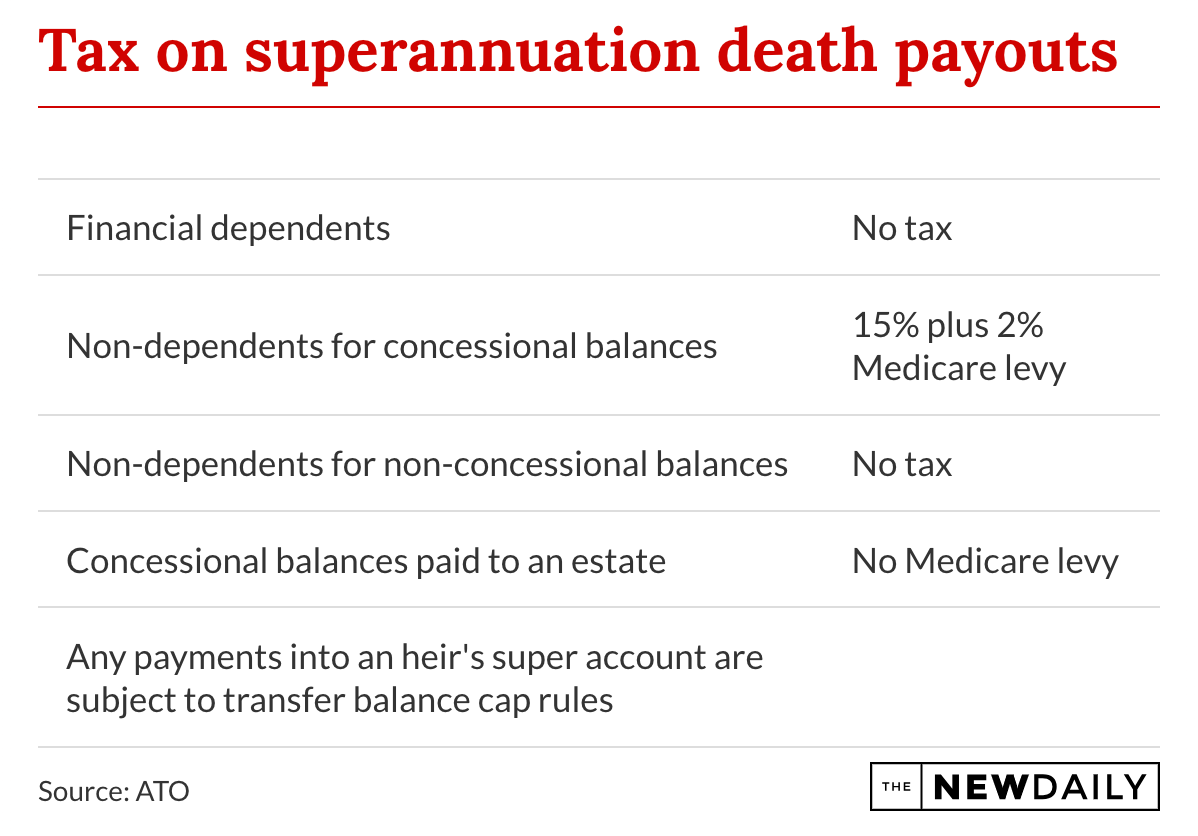

Super death payments and tax

Super money left directly to dependents via a nomination or a decision by trustees is not taxed.

Dependents, according to the Australian Taxation Office, include children under 18, current and ex-spouses and de factos, and others you have been financially supporting.

Children under 25 who are students or dependents are also not taxed on super death payments.

Grandchildren are not considered dependents unless there is some special circumstance like disability.

However, for anyone who is not a dependent the ATO will take out 15 per cent of the payout plus the Medicare levy, effectively making it 17 per cent.

There are extra complications here.

Shane Ellis, of Shane Ellis Legal, says: “There are taxable and tax-free components to superannuation. Taxable components relate to concessional super contributions entering the fund.”

That means any money put in the fund through super guarantee payments made by your boss, salary sacrifice or personal concessional taxable contributions that were only taxed at 15 per cent on the way in.

Those taxable contributions and the earnings on those contributions will be taxed at 17 per cent when paid to a non-dependent.

What avoids the tax?

Non-taxable contributions include any payments you made to your fund that did not have a tax deduction attached. These include non-concessional one-off payments including downsizer contributions made on the sale of the family home.

These are not taxed on the way out of super because the ATO considers you must have paid tax on the money before you put it in.

If your super is made up of concessional and non-concessional payments your fund will have a record of how much of your balance is in both categories, so look at your annual statement for details.

Earnings in the fund are allocated to concessional and non-concessional payments, according to the ratio of both balance types.

Will or direct payment?

If your super money will go to non-dependents you have the option of having your super paid into your estate and managed under the terms of your will, instead of paying directly to a beneficiary.

Ellis says there is an advantage to paying the money into your estate.

“If the super benefit is paid into your estate directly then the Medicare levy is not charged and you save 2 per cent on the tax bill,” he said.

However, there can be a negative there. Under the old adage “where there’s a will there’s a relative”, your will could be challenged from unexpected quarters and the money might not finish up where you want it to go.

In fact, a will can be challenged by pretty much anyone, so there is a risk here.

However, Rasiah says there are also benefits to directing money into an estate, because your estate can pay out to a lost dogs home or anyone else you stipulate.

Super fund trustees are far more restricted as to who they pay to.

Philanthropy stymied

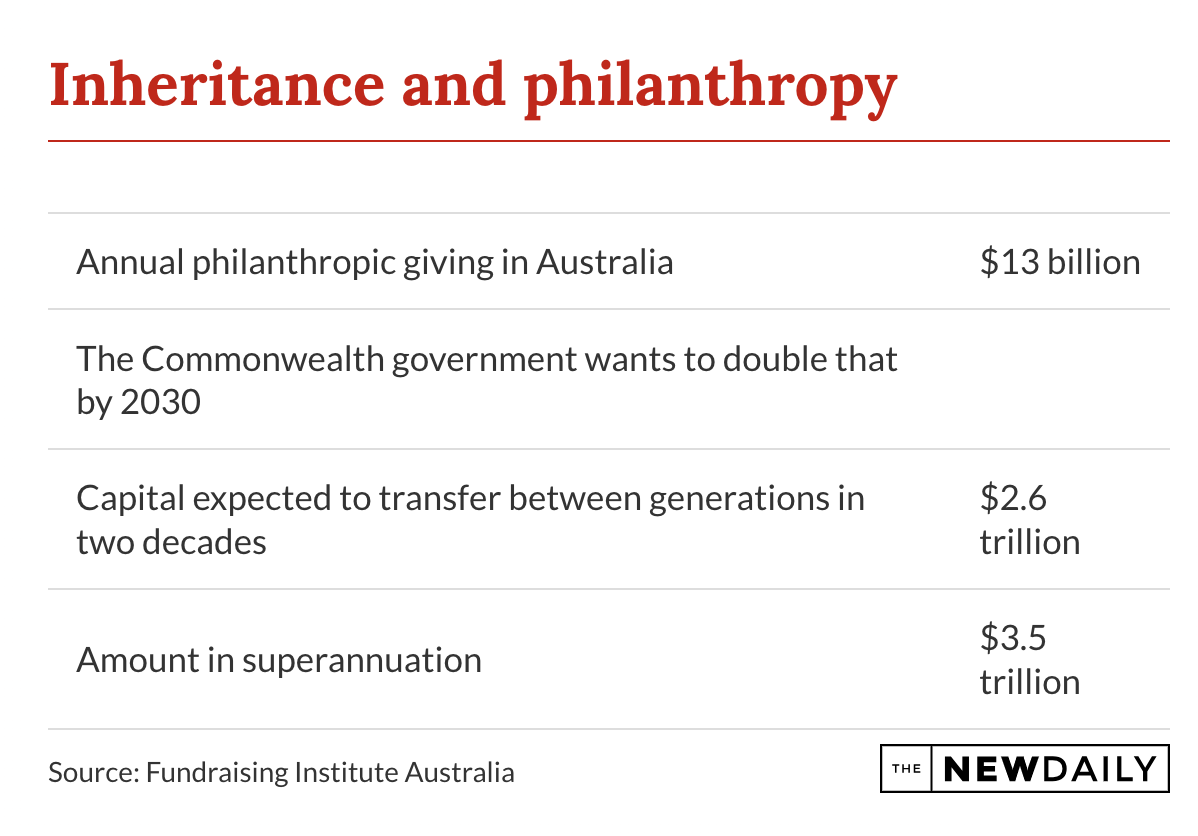

There are big bucks now in the super system and a massive $2.6 trillion is expected to be paid to heirs in intergenerational transfers over the next two decades.

But the current tax laws make it harder for charities and good causes to get a stake of those inheritances. That’s because charitable giving must go through wills, not direct payments from super funds, and so is taxed at 15 per cent.

Philanthropy Australia CEO Jack Heath wants that to change.

“We are supportive of the idea that philanthropic bequests should be able to be made directly from superannuation,” Heath said.

“It’s part of our advocacy work with government to help introduce this reform.”

Given the federal government has said it is aiming to double the $13 billion Australians are currently making in philanthropic payments annually by 2030, perhaps Heath’s views will get a hearing.

However, Association of Superannuation Funds of Australia deputy CEO Glen McCrea warned “unintended consequences could arise in regard to financial dependents of a deceased person” because they could not challenge payments to charity.

This story first appeared in our sister publication The New Daily, which is owned by Industry Super Holdings