Figures provided to The New Daily by Investment Trends showed that in June this year 1.4 million Australians had online trading accounts, up from 750,000 in June 2019 and 1 million in December 2020.

“The onset of corona really escalated the number of online traders because people had more time on their hands,” said Kurt Mayell, research chief with Investment Trends.

Because of that extra time people were interested in learning a new skill.

“That move was especially noticeable among people in the younger age groups,” Mr Mayell said.

Collapsing interest rates which pushed down savings rates to almost zero also encouraged more people to get into investing.

Earning next to nothing on their money in the bank, they sought new ways to get ahead financially, Mayell said.

Australians with online broking accounts

Of the increase in accounts to 1.4 million, “over 250,000 were newcomers to the market while the rest were dormant clients who had returned after staying out of investment for a while,” he said.

Many of the new investors were younger people.

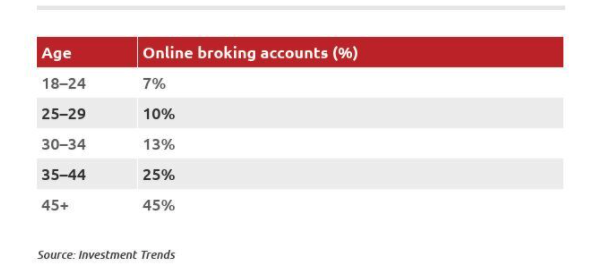

Of those with an online broking account by June, 17 per cent were under 30 and a further 13 per cent were between 30 and 34. Those over 45 accounted for 45 per cent.

Age of people with online accounts

Advice changes

The rise in online accounts has also led to changes in the way advice is accessed.

In the past, investors typically would have had an adviser or stockbroker to help them plan their trades. But now that has changed.

“It’s less an ongoing relationship and more transaction-based financial advice,” Mayell said.

That means people will seek out an adviser to guide them on a one-off basis when an issue comes up, and pay for that separately.

The costs of online broking have dropped dramatically in recent years.

CBA’s Commsec can deliver share trades for as little as $10 in brokerage fees, while Think Markets delivers trades for $8 and SuperHero delivers trades for $5.

For traditional telephone service brokers, costs can be about 0.3 per cent of the value of each transaction.

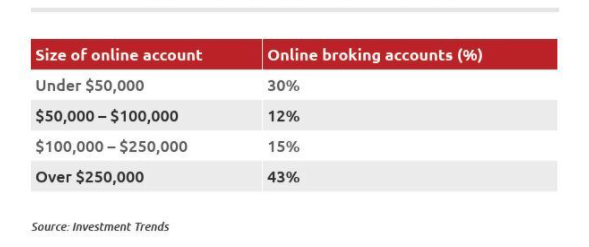

Size of online accounts

Want to get involved? Here are some points to consider

Anyone thinking about trading for the first time should consider several key points.

The first is to “understand the business,” said Rob Goudie, principal of Consortium Private Wealth.

That means you need to do your research on the companies in which you plan to buy shares.

Understand the product and its place in the market and try to get your head around the company’s business model.

The second point is diversification.

“Don’t put all your eggs in one basket,” Goudie said.

Spread your capital across more than one stock or sector.

“That can be done very cheaply today through ETFs (exchange-traded funds) or managed funds,” Goudie said.

“ETFs can give you exposure to the best and the biggest businesses in the world.”

ETFs offer a huge range of investment options and provide access to global sharemarkets.

“There are cyber security ETFs, cryptocurrency ETFs, ethically-based options, or sectors like tech and green energy,” Goudie said.

Remember, though, that the market is high at the moment – and if there is a correction or crash, it doesn’t necessarily mean your investment choice is no good.

In those situations, it pays to hang on, because “a rising tide will lift all boats when the market turns,” Goudie said.

However, if there are issues specific to your investment that are pushing it down, you may need to consider your position and get out, he said.

This article was originally published on The New Daily. Read the original story here.