Bionic ear shares climb as Cochlear lifts net half-year profit

Shares in Cochlear have soared after the hearing implant supplier lifted its first-half profit by 32 per cent, increased its dividend and raised its full-year earnings guidance.

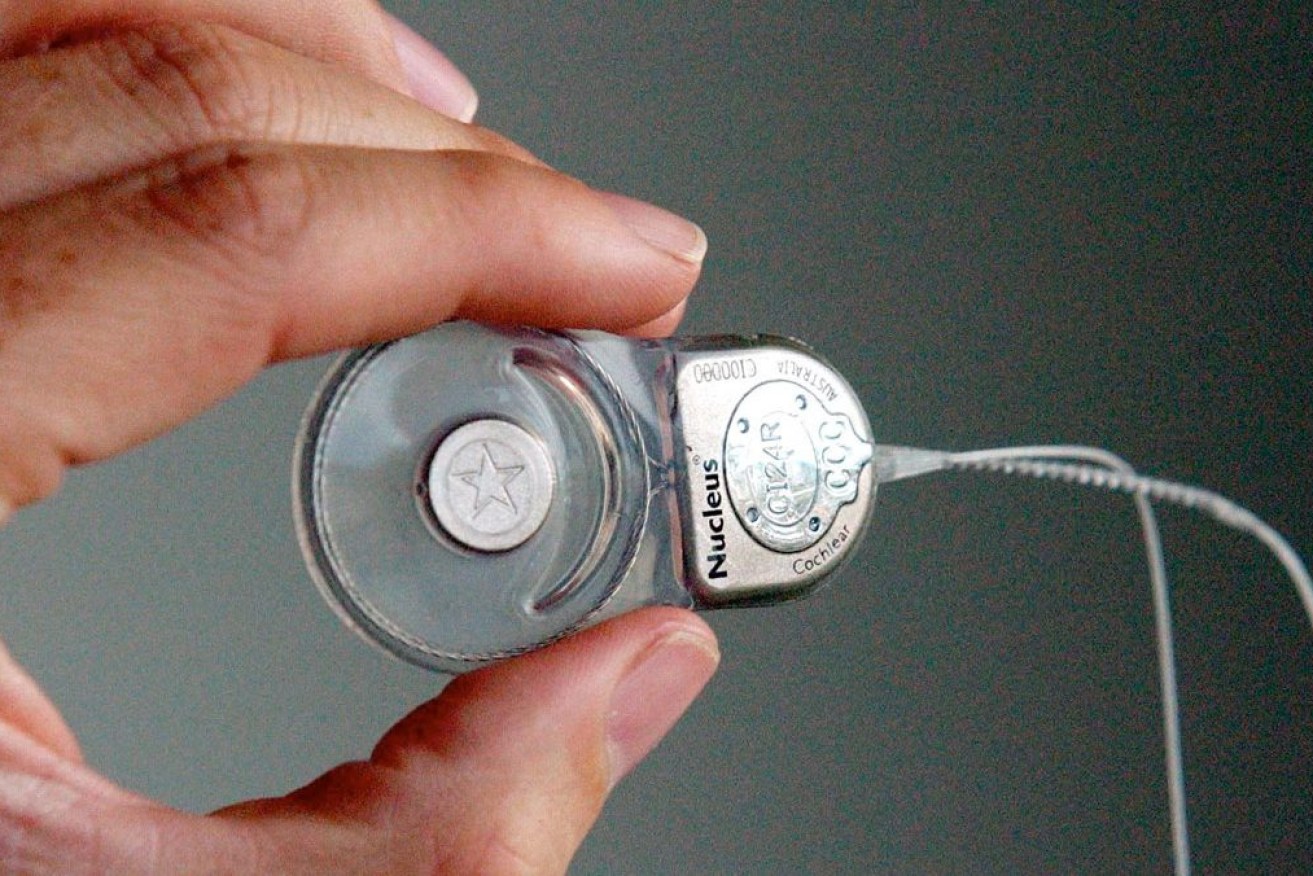

Photo: Dan Peled/AAP

In early trading, Cochlear shares broke the $100 mark to reach $100.33 before pulling back to be $7.14, or 7.83 per cent, higher at $98.32 at 10.40am (AEDT).

Cochlear’s net profit for the six months ended December 2015 climbed to $94.03 million, from $71.4 million in the prior corresponding period.

The lower value of the Australian dollar and the recent release of new products helped to boost its sales and profit.

Sales rose 32 per cent to $581.7 million and were up 16 per cent on a constant currency basis.

Cochlear raised its profit guidance range for the 2016 full financial year to between $180 million and $190 million, based primarily on the lower value of the Australian dollar.

Cochlear also lifted its interim dividend by 22 per cent to $1.10 per share.

Chief executive Chris Smith said the positive momentum of 2015 was continuing into 2016, with Cochlear’s implant business and services business delivering strong growth.

He said strong market acceptance of recently launched products, including Nucleus Profile implants and the wireless Nucleus 6 sound processor, had driven market growth over the past year.

“Looking forward, we have an exciting pipeline of products to be released over the next 18 months across all categories of our business,” Smith said on Thursday.

“The services business continues to grow strongly and now represents around 25 per cent of sales revenue.

“We are building a lifetime relationship with our recipients to provide products, programs and services, and expect its contribution to continue to trend upward over time as the recipient base grows.”

OptionsXpress market analyst Ben Le Brun said it was a glowing result from Cochlear.

He said Cochlear’s growth numbers were impressive, the profit beat market estimates, and the full-year guidance had been lifted, so the company’s share price was being rewarded.

“The market is clearly hearing what they (Cochlear) have said today,” Le Brun said.

AAP