Santos in trading halt as capital raising continues

UPDATED: Investors have taken up just over half the retail entitlements offered by Adelaide-based oil and gas producer Santos during its bid to raise $2.5 billion.

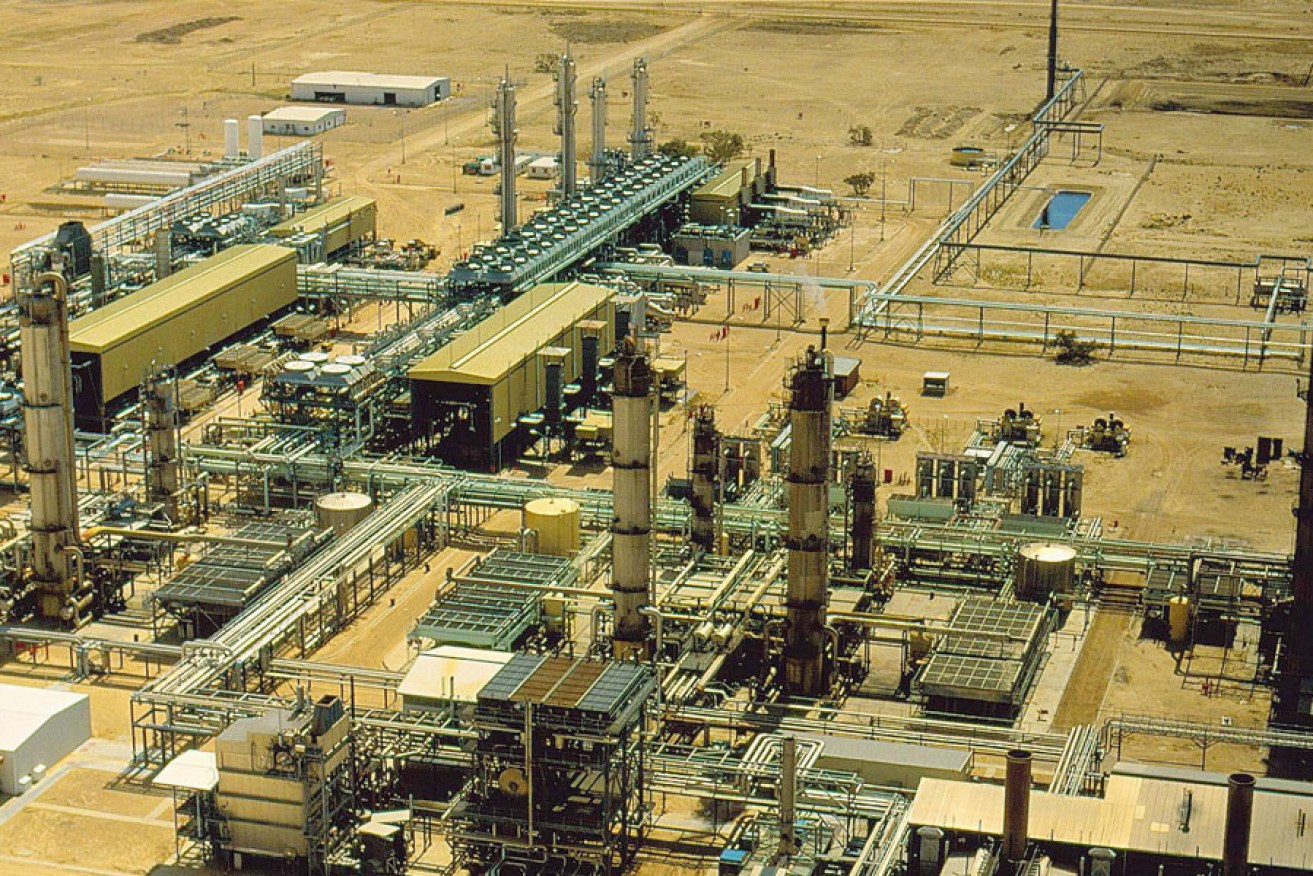

The Santos gas plant in Moomba, South Australia. Supplied image

Following a request for a trading halt this morning, Santos announced to the ASX this afternoon $775 million, or 57 per cent, of its retail entitlement offer had been taken up.

The remaining 152 million retail entitlements are offered under the retail shortfall bookbuild which will be completed prior to the market opening tomorrow.

Shareholders were offered purchase shares at $3.85 for every 1.7 share they owned.

Santos’ executive chairman Peter Coates said on November 13 he anticipated a strong take up of shares to “strengthen our balance sheet and restore long term value for shareholders.”

Santos announced to the ASX the retail entitlement offer was expected to raise about $1.35 billion.

Last month Santos raised $1.17 billion from an institutional entitlement offer in a bid to reverse its financial fortunes.

At the time, Santos stated about 86 per cent of entitlements that had been made available to eligible institutional shareholders were taken up.

Santos aimed to raise a $2.5 billion rescue package to cut its debt and secure its position in the wake of a rejected takeover bid from private equity firm Scepter.

The embattled company has endured a tough year with almost 800 workers shed from its operations.

In October Santos announced the sacking of 200 office-based staff at its Adelaide operations and earlier 565 workers were stood down around the country in a bid to stem the financial bleeding.

Santos said the job cuts had reduced capital expenditure by 55 per cent and unit production costs by 11 per cent.