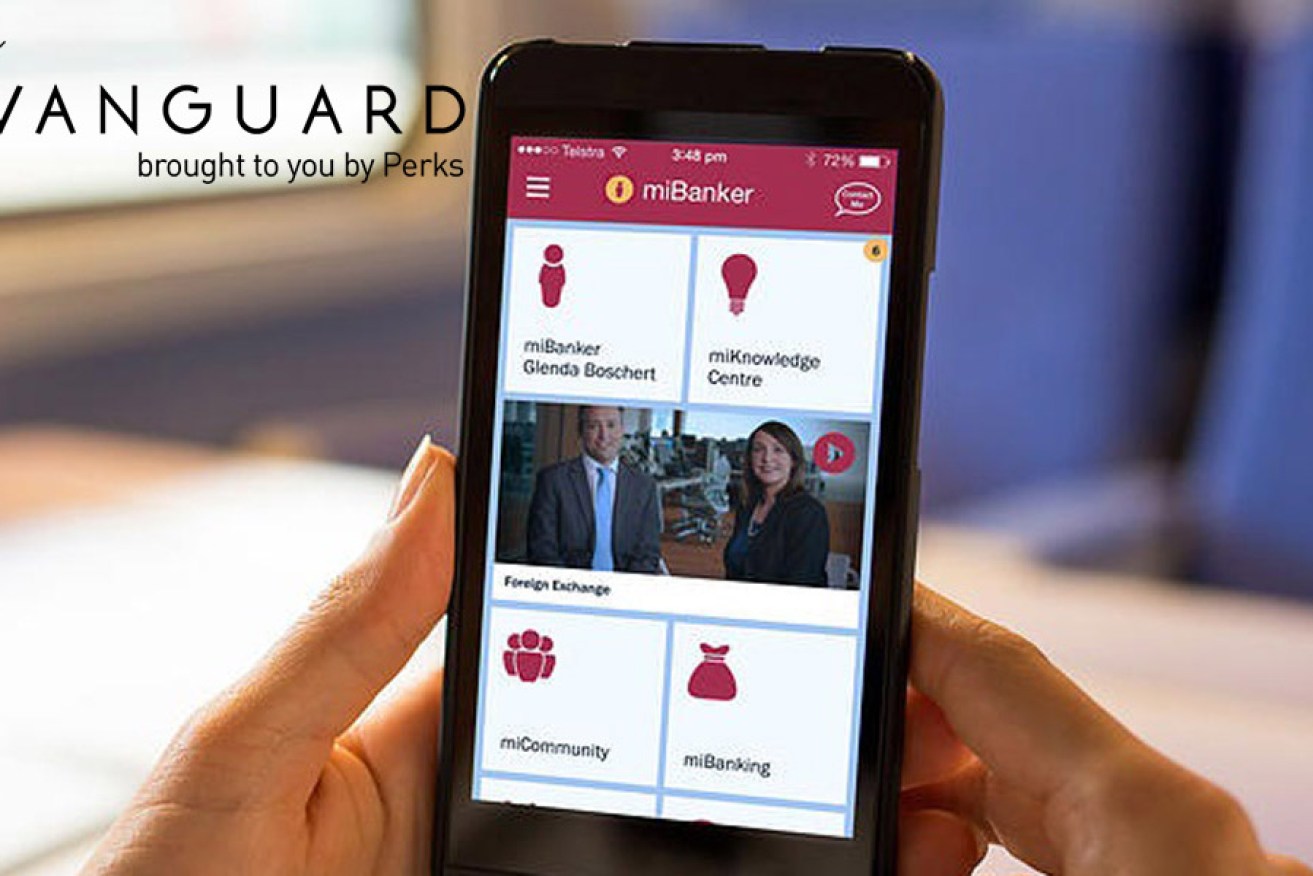

People do not have a lot of time to spare when they are running a business. So a service that delivers relevant, timely and tailored information to the busy business owner-manager is going to prove popular. And so it seems with Bendigo Bank’s business phone app called miBanker.

A free app available to Bendigo’s business customers, miBanker provides information ranging from daily stock exchange reports and business news to videos that speak to the challenges faced by business owners and managers.

Bendigo says it is ahead of the banking pack with the app which became available with a ‘soft launch’ in February after first being proposed by the app developer Bhive Group almost two years ago.

Bendigo’s senior manager, business banking strategy (retail), Matt Davey says the approach from Bhive Group was timely because, while Bendigo had been improving its customer phone apps, it did not having anything specifically designed for business.

“Business customers trust us so we thought if we delivered some technology to them to help run their business better that has video content, and they can access when they want it, then that would really resonate,” Davey told The Vanguard.

“Because people are so busy running their business from nine to five or eight to six (o’clock), we wanted to provide one place to go to get all the other bits and pieces of information that will help them be more successful.”

The full suite of miBanker information includes:

- Daily updates from the Australian and overseas stock markets

- Latest business news, including ABS and Reserve Bank announcements

- Weekly economic updates from Bendigo Bank

- Regular video tips on business strategies and marketing tools

- Invitations to events and seminars

- Access to a customer’s relationship manager and real time feedback on issues

- Regular ‘customer pulse’ questions that tap the thinking of business customers.

While much of the miBanker information is informative, a key objective of the app is to create a direct link with a customer’s personal business banker.

Customers opt to connect with a particular business banker when they register and that individual’s contact details, including email and mobile phone number, are readily available. This accessibility is further facilitated with a ‘compliment, complaint, or suggestion’ button which automatically sends a message to the customer’s banker and elicits a prompt response.

“It’s easier than having to type an email,” Davey said.

The regular video clips available via the app are also tailored to be useful and effective. Rather than promoting a particular bank product, the videos are designed to address specific challenges facing business, such as how best to manage cash flow.

The subject matter for the videos is also informed by an innovative Bendigo tactic to tap the mood and interests of business customers. The bank sends a fortnightly ‘customer pulse’ question – what were the key issues in the Federal Budget, for example – with customers able to nominate their views via the app. Respondents are then able to see what their peers are thinking by reviewing the poll results, much as occurs on a number of mainstream news sites.

Events that might interest particular customers are offered on a geographically tailored basis.

“As our customers consume the content, we will get a really good picture of what they are interested in, what their challenges are, and then work out how we can help support them,” Davey said.

“We are helping improve their business acumen by keeping them better connected with what’s going on,” he said.

“None of the other banks have anything like this.”

MiBanker has been well received with about 1150 business customers having signed up to date, and “the numbers are moving in the right direction”.

With training of frontline staff now underway to enhance their confidence in the technology Bendigo expects “the numbers to climb considerably in the next three months”.

MiBanker is not Bendigo’s only recent innovation with the bank launching in 2014 a unique retail point of sale mobile payment solution called redy that enables users to donate loyalty credits to community causes.

Bendigo also launched GoPos®Lite a device that is plugged into a mobile phone and becomes a secure electronic funds transfer system for small businesses.